Market Update

Crossrail - the new train line across London - appears to be boosting house prices, at least a year before opening.

According to the Land Registry Slough, where the trains will stop, saw a 19% rise in prices in the year to February, the biggest increase in the country.

The Elizabeth Line, as it has been named, will also run through Hillingdon, where property prices jumped 17.1%.

To the east of London, prices rose by 16.9% in Havering, also on the line.

Other nearby local authority areas also saw big increases, including Thurrock, where the figure was 17.2%, and Barking and Dagenham, which saw a 16% rise.

In Slough alone prices jumped by 2.1% between January and February alone.

The Elizabeth Line is due to open between Liverpool Street and Shenfield in May next year.

Across England and Wales as a whole, house prices went up by 6.1% in the year to February, bringing the average price of a house or flat to £190,275.

The UK regions set for growth

Residential property prices across many parts of the UK look set to cool over the next few months amid ‘Brexit’ uncertainty, but two regions have been identified as offering major room for growth over the next few months, according to a new survey.

A fresh poll conducted by the Royal Institution of Chartered Surveyors (RICS) suggests that the forthcoming referendum on European Union membership and elections in Scotland, Wales and Northern Ireland will lead to a slowdown in the overall UK housing market, led by the housing market in London.

“Elections inevitably bring with them periods of uncertainty in the market, and our figures would suggest that next May’s devolved elections are no exception,” said Simon Rubinsohn, chief economist at RICS.

“Likewise, the EU referendum is likely to be an influencer in terms of the damper outlook for London in particular,” he added.

The recently introduced 3% stamp duty surcharge on second homes and buy-to-let investments were an additional factor contributing to the slowdown.

However, the North West of England and Northern Ireland look set to buck the falling house price trend, with experts forecasting that these areas will offer the greatest room for growth over the spring and early summer periods.

North West of England

In contrast to the turbo-charged property markets in London and the South East, capital growth in the North West of England has been more subdued since prices bottomed out in 2009, with a modest rise in property values recorded in recent years.

Like most places, there are regional variations across the North West of the country, with the market in Manchester widely expected to record the greatest level of growth in the medium to long-term, supported by a strengthening economy, fuelled in part by plans to create a Northern Powerhouse.

“As the largest area of economic intensity in the UK outside London and the South East, Greater Manchester is seeing strong business growth and an economy expanding at twice the national average, and that success is feeding into house prices in the most desirable boroughs in the area,” said Christian Spence at Greater Manchester Chamber of Commerce.

“These price increases are good news in terms of signalling the increasing desirability of our city-region, but they also signal a constriction in supply,” he added. “We must move quickly to support greater investment in new housing suitable for our growing population.”

Last year, Manchester was named in a survey, conducted by HouseSimple, as the number one place in the UK to invest in property, with property prices in the city more likely to ‘boom in the next 10 years’ than anywhere else in the country, thanks partly to a rapidly growing population.

“Manchester is a modern, thriving city and the Northern Powerhouse initiative has focussed a lot of attention on it. It is already a great city in terms of transport links and the modern railway revolution that is currently taking place there is going to be a game-changer in terms of improving access,” said Jonathan Stephens, managing director of Surrenden Invest.

Northern Ireland

The housing market in Northern Ireland is showing little sign of uncertainty from the EU referendum and recent stamp duty changes, with surveyors also expecting to see a hike in sales in the coming three months based on a strong performance during the first quarter of this year.

A severe shortage of properties in the market is placing upward pressure of home prices in Northern Ireland, in addition to the fact that Northern Ireland’s housing market remains in recovery mode, with prices and sales still significantly below their peak.

“The changes in stamp duty, in addition to the upcoming EU referendum and the forthcoming Assembly election, are combining to create uncertainty in the economy,” said RICS

Northern Ireland residential property spokesman Samuel Dickey. “However, there is little sign of this impacting on the Northern Ireland housing market at this stage in terms of expectations for prices and sales.”

The latest survey suggests that just over 46% of surveyors expect prices in Northern Ireland to continue increasing between April and June, with 37% of surveyors expecting sales activity to rise over the same period.

RICS said it expected residential property prices in Northern Ireland to increase by about 5% over 2016.

Sean Murphy of Ulster Bank said that surveyors were positive about expectations for both house prices and sales activity.

“March brought the first quarter of 2016 to a close and the latest survey suggests that it was a relatively strong start to the year in terms of prices,” he said. “Mortgage activity at Ulster Bank remains strong and we expect to continue that in the months ahead.”

Long-term outlook

In the longer term, RICS forecast that house prices will rise by just over 4% annually in England and Wales – regardless of the results of the EU referendum and the elections.

“The imbalance between demand and supply will still exert a strong influence on the market, with house prices expected to rise by close to 25% over the next five years,” said Simon Rubinsohn.

Market News

- Market News

London Property Market Update

While Covid-19 still remains a top concern, the rollout of a vaccine across the UK suggests we could be witnessing the beginning of the end of the pandemic. We're optimistic about the year ahead. I anticipate that activity will soon return to the UK real estate market, and we should be able to expect some impressive house price growth in the coming months. Rightmove currently predicting houseRead More

Market News

Market NewsIt’s an ideal time now to invest in property Post Brexit Great Deal !!!

Strongest rebound in sales in UK property market to pre-COVID-19 levels after the market reopened. Property prices are set to rise very shortly. With an interest rate is the lowest on record. A surge in borrowing is predicted over the next 6 months; consequently property prices will start rising. So investing now in a property while the market is returning back to relative normality is the bestRead More

Articles

ArticlesProperty prices in luxury London homes set to rise by 20% in the next five years.

After a prolonged period of sluggish sales, the weak pound is tempting overseas buyers back to Belgravia, Knightsbridge, Mayfair, Kensington and Chelsea, Marylebone and Notting Hill with discounts of around 35%. The price of a luxury home in the heart of London is set to climb 20% over the next five years after a prolonged spell of sluggish sales and discounting. According to housing marketRead More

- Market News

New builds are the only home type with rises in every borough since 2014

Help to Buy has boosted the new build market but even second hand new homes retain value better than existing ones, according to a new report. The new build house price growth premium in every borough New Homes have risen more quickly in price than existing properties in every borough in London over the past five years, new analysis reveals today. It shows that across the capital asRead More

Market News

Market NewsBrexit buying opportunity for Mideast and Asian property investors

It's always a challenge for investors to find the exact bottom of the market, with the risk being they miss the boat. Overseas buyers make the most of currency swings Some overseas investors — particularly from the Middle East and Asia — have identified a buying opportunity. Private investors and corporates are seeking to make the most of currency shifts. There are some ChineseRead More

Market News

Market NewsNewspaper headlines: Concerns over buy-to-let market

A crackdown on the buy-to-let market and a warning on the EU referendum put the Bank of England on the front pages. The Times leads on a move by the Bank to make it more difficult for people to borrow money for buy-to-let schemes. "In the most concerted attempt yet to cool the housing market," says the Times, "the Bank announced criteria that will make it tougher to secure a loan on aRead More

Market News

Market NewsLandlords in last-minute rush to beat stamp duty rises

Landlords, estate agents and solicitors are in a last-minute rush to complete property deals ahead of a stamp duty rise that takes effect on Friday. Anyone buying a home that is not their main residence will face a 3% Stamp Duty surcharge. In Scotland, the equivalent tax - the Land and Buildings Transaction Tax (LBTT) - is also being up-rated. From midnight on Thursday the duty on aRead More

Market News

Market NewsWhat will happen to the property market in 2016?

The property market will have rather more on its plate in 2016 than the perennial issue of whether house prices will go up or down. The recent decision of the US central bank, the Federal Reserve, to raise interest rates for the first time since the summer of 2006, has opened the door for the Bank of England finally to follow suit. And one thing that will certainly happen in England and WalesRead More

Market News

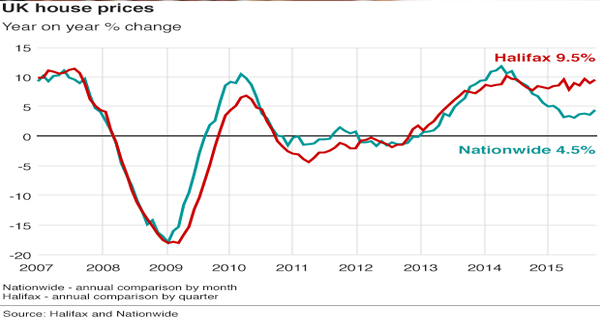

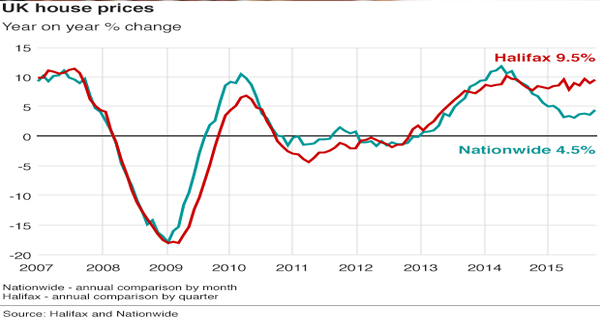

Market NewsUK house prices rose 9.5% in 2015, says Halifax

UK house prices rose by 9.5% in 2015, according to the lender Halifax, making it the fastest annual increase in nine years. In the last month, prices went up by 1.7%, said the Halifax, bringing the average price of a home to £208,286. However, other lenders, such as the Nationwide measure, put the rate of increase much lower. Last month, it said prices rose by 4.5% in 2015, less thanRead More

It’s an ideal time now to invest in property!!

Strongest rebound in sales in UK property market to pre-COVID-19 levels after the market reopened. Property prices are set to rise very shortly. With an interest rate is the lowest on record. A surge in borrowing is predicted over the next 6 months; consequently property prices will start rising. So investing now in a property while the market is returning back to relative normality is the best time for investors.

Housing market has recovered strongly in England. The rebound in sales has been led by cities in northern England – Leeds, Sheffield and Manchester.

Greater London also indicates annual growth ranging from 2.7% plus. Demand overtaking supply, increased demand and low availability of homes for sale, is pushing UK house prices upwards. The property prices is remained to grow within the +2% to +3% range over the next coming year.